There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Options Trading is a lucrative business for most traders.

Big traders rely on different options selling strategies to make money in the market.

But most retail traders try options buying with small capital.

Come & join us to learn in-depth knowledge on options that helps to make money even using options buying.

| star star star star star_half | 4.9 (51 ratings) |

Instructor: Indrazith Shantharaj

Language: English

Validity Period: 365 days

Most new traders enter the options market with a small capital base, so they naturally gravitate toward buying options. It feels simple, affordable, and the potential returns look exciting.

But what many don’t realize is this: Time Decay constantly works against option buyers. Unless the market moves fast and strongly in your favor, your premium starts eroding — even if your view is right.

To succeed as an options buyer, your trades must align with three key principles:

A high probability of success (based on logic, not luck)

Minimal loss when your view goes wrong

The potential for a small-to-large reward when your view is right

Additionally, understanding Open Interest helps you gauge where big players are active — a powerful edge when used correctly.

But here's the other side most traders miss:

Options selling, when done with proper risk management, can offer a higher probability of consistent returns — especially when the market is range-bound or lacking strong momentum.

By learning both buying and selling strategies, you’re not just hoping for the perfect breakout — you’re positioning yourself to win in different market conditions.

This course dives deep into both sides — smart option buying and strategic option selling — and offers practical strategies to help you make more informed, confident decisions in live markets.

Because true edge in options trading doesn’t come from guessing direction…

It comes from understanding structure, timing, and probabilities.

Content:

1 - Introduction to Options

2 - Open Interest (OI) Analysis

OI Definition

Difference between OI and Volume

OI and Futures Interpretation

OI and Options Interpretation

How to know the direction using OI?

OI Trades Examples

3 - How to earn good returns every month?

4 - Important Options Trading Strategies

5 - One tested Intraday Trading System

6 - Application of Options Strategies in Intraday Trading

What is Included?

- 1 year access to the course (you can watch any number of times)

- Support via Whatsapp 8310843209

What's not covered?

1-Fire fighting in options

2-Any strategy to earn millions in one day

Know Your Trainer

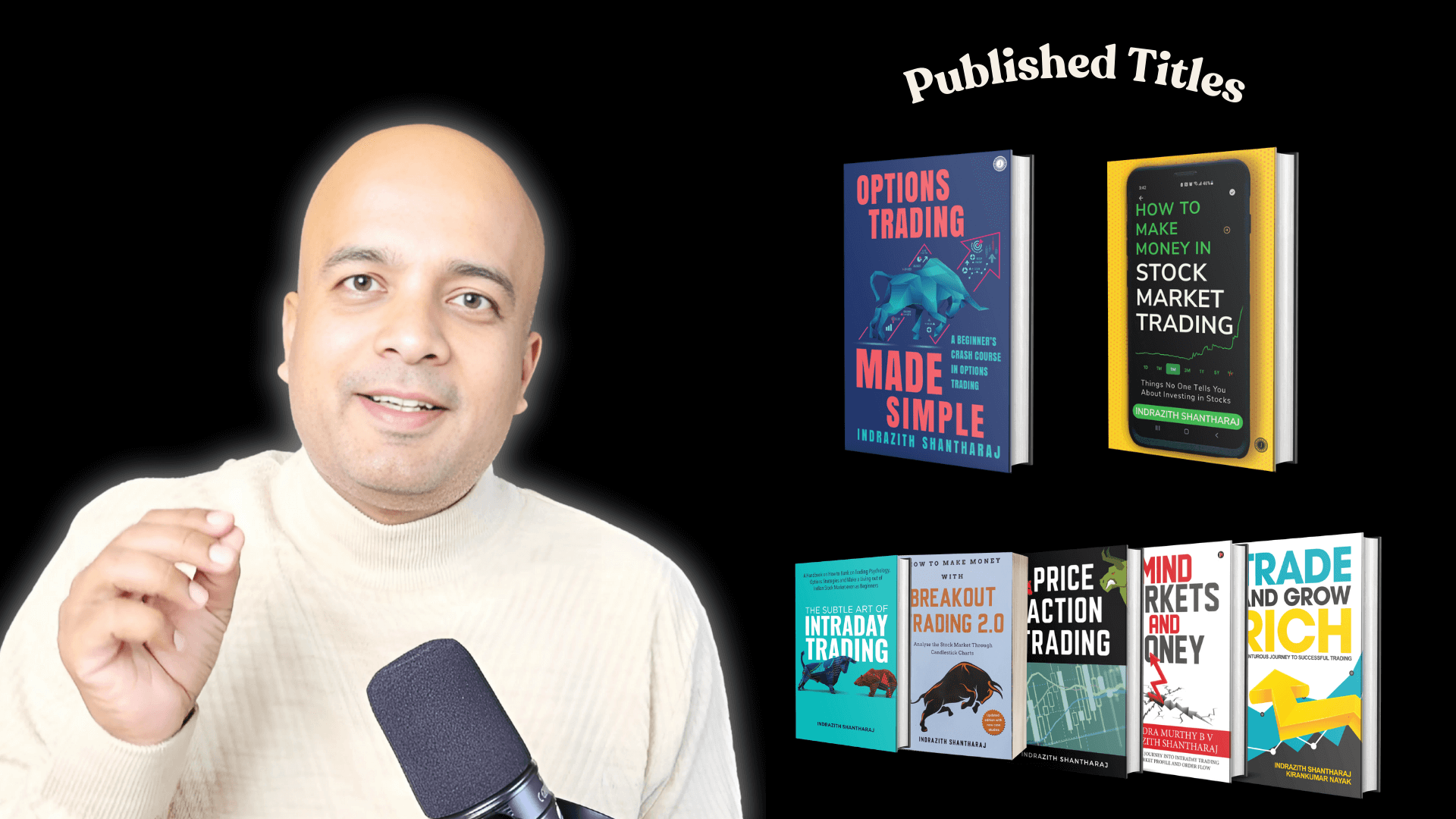

Indrazith Shantharaj is a full-time options trader and author of 10 best-selling books related to the stock market.

His answers have received over 21 Million+ views on Quora.

He uses market profile concepts, price action trading, and many self-designed trading systems to manage his trades.

FAQ

What are the prerequisites to take this course?

Ans: An open mindset is the most important thing. Besides, it would be best to have a computer with internet connectivity and basic knowledge about options.

Are these training videos pre-recorded?

Ans: Yes, it's a pre-recorded session.

Do I need to purchase any software?

Ans: No. There is no need to purchase any software to apply these options strategies.

Can I trade it by being in a full-time job?

Ans: One can shortlist a trading system and define 100% rules to reduce the number of trades. Then you can quickly implement the concepts even if you are in a full-time job.

Are these methods only apply to Index, or can I use them for stocks?

Ans: Some options strategies can only be applied on indices (due to high liquidity). Whereas, some strategies can be applied on stocks (F&O category) as well.

Will there be any support after the completion of the course?

Ans: Yes, One can watch the course any number of times in 1-year. Besides, you can reach us on Whatsapp +91 8310843209 or send an email to support@stockmarketcourses.in

Refund Policy - No Refund

DISCLAIMER

The information contained herein is generic in nature and is meant for educational purposes only. Nothing here is to be construed as an investment or financial or taxation advice nor to be considered as an invitation or solicitation or advertisement for any financial product. Readers are advised to exercise discretion and should seek independent professional advice prior to making any investment decision in relation to any financial product.

In view of the above, there can thus be no guarantee or promise given for the success or profitability of investments made. By using this website/course, you expressly acknowledge and agree that Profile Traders or Stock Market Courses or any individual cannot be held liable for any and all damage resulting from investments made.